Beyond the AI Bubble: The Infrastructure Layer Everyone's Missing

Why enterprise platforms deploying 50,000+ agents matter more than AGI speculation

You’ve heard the warnings.

Market analysts claim the AI bubble is 17 times larger than the dotcom crash.

The narrative is compelling and frightening in equal measure.

OpenAI sits at the centre of what critics describe as a circular financing scheme—receiving investments from Microsoft, Nvidia, Oracle, and AMD, then immediately using that capital to purchase services from those same investors. The company is projected to lose $8.5 billion this year whilst somehow committing to $1.3 trillion in spending for 2025 alone.

That’s more than the entire US defence budget.

Microsoft books OpenAI’s cloud spending as its own revenue growth.

Nvidia invests $100 billion into OpenAI, which then buys Nvidia chips with that money.

Oracle signs a $300 billion five-year deal with a company that won’t be profitable until 2029.

It’s financial engineering that makes the 2008 mortgage crisis look straightforward.

Meanwhile, MIT research reveals that 95% of generative AI pilots at companies are failing to deliver measurable returns at the same that the Magnificent Seven tech companies—Apple, Microsoft, Nvidia, Amazon, Meta, Google, and Tesla—now represent 34-40% of the S&P 500’s entire value.

Your pension, your index funds, your retirement accounts are all massively exposed to AI whether you realise it or not.

When Sam Altman is speed-dating investors like someone who knows the music is about to stop, should we be concerned?

Let’s get into why I think AI is nowhere near a top.

Why the Bubble Narrative Is Incomplete

Here’s what I think the growing number of bubble prophets are missing: they’re conflating two entirely different markets that happen to share the letters “AI.”

Why? Because they have no front line organisational knowledge of what’s actually going on. They’re using a financial market lens because they have zero boots on the ground optics into what lines of business and IT departments are planning and deploying.

Yes, we know OpenAI is burning through billions pursuing artificial general intelligence with uncertain timelines and unclear business models, but in the meantime, a different category of AI player is quietly building sustainable, profitable businesses by solving genuine business problems.

These aren’t foundation model providers competing for AGI supremacy. They’re infrastructure platforms enabling enterprises to actually deploy AI in production.

The data tells a story the bubble narrative ignores.

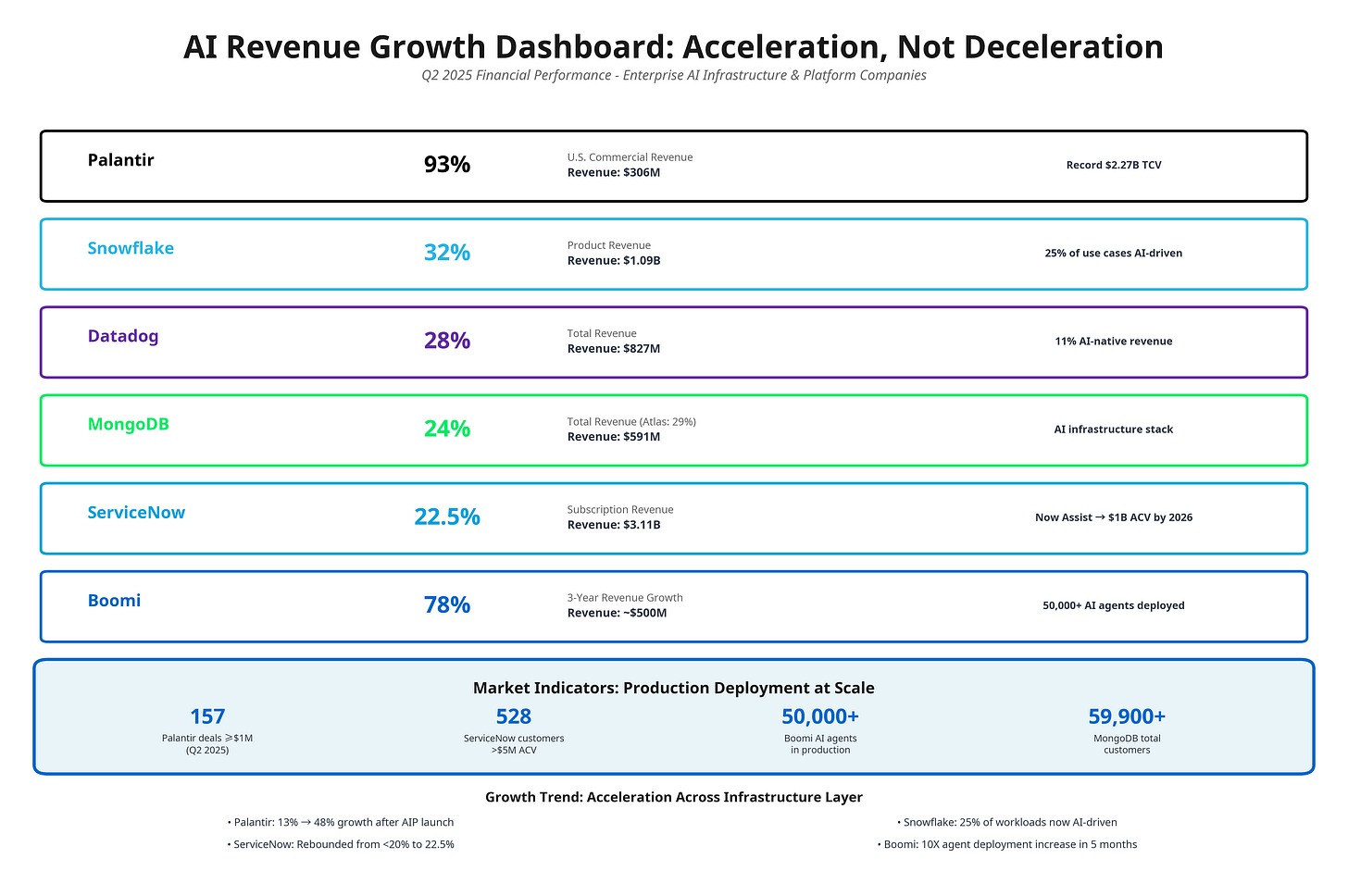

ServiceNow reported $3.113 billion in subscription revenue for Q2 2025, representing 22.5% year-over-year growth. Their AI product, Now Assist, is on track to hit $1 billion in annual contract value by 2026, with the CFO noting it “continued to surpass net new ACV expectations, fueled by an increase in both deal volume and size quarter-over-quarter.”

Palantir’s transformation is even more dramatic. Their Artificial Intelligence Platform (AIP), launched in 2023, drove a revenue inflection from 13% growth to 48% growth. U.S. commercial revenue surged 93% year-over-year to $306 million. The company closed 157 deals of at least $1 million in Q2 alone, including 42 deals exceeding $10 million.

These aren’t accounting tricks or circular financing. These are real customers—thousands of enterprises—paying for production deployments that deliver measurable business value.

The Picks and Shovels Players You’re Not Watching

Whilst everyone obsesses over who will win the foundation model race, a different category of companies is experiencing genuine adoption acceleration.

Think of them as the picks and shovels of the AI gold rush—except unlike the California Gold Rush, these companies are more profitable than the prospectors.

ServiceNow has positioned itself as what CEO Bill McDermott calls “a full stack agentic operating system for the enterprise.” The company closed 89 transactions over $1 million in net new annual contract value in Q2 and now has 528 customers spending more than $5 million annually—up 19.5% year-over-year. Every business process in every industry is being refactored for agentic AI, and ServiceNow is providing the platform to make it happen.

MongoDB is emerging as critical AI infrastructure. The company reported $591.4 million in total revenue for Q2 fiscal 2026, up 24% year-over-year. CEO Dev Ittycheria noted that “many of our recently added customers are building AI applications, underscoring how our value proposition is resonating in the AI era and why MongoDB is emerging as a key component of the AI infrastructure stack.”

Snowflake reported product revenue of $1.09 billion in Q2 fiscal 2026, representing 32% year-over-year growth. The most telling metric: 25% of customer use cases are now AI-driven. This isn’t experimentation—it’s production deployment at scale.

Boomi, the integration and automation platform, achieved 78% revenue growth over three years, earning a spot on the Inc. 5000 list of America’s fastest-growing private companies. The company has deployed over 50,000 AI agents into production worldwide, with a 10X increase in agents created, governed, and deployed since general availability launched in May 2025.

Datadog reported $827 million in revenue for Q2 2025, up 28% year-over-year, with AI-native revenue reaching 11% of total revenue. As AI workloads proliferate, the need for sophisticated observability and monitoring becomes critical—and enterprises are paying for it.

These companies share common characteristics that distinguish them from bubble concerns. They’re profitable or have clear paths to profitability.

They serve tens of thousands of enterprise customers with real revenue, not circular financing. They’re growing at 14-93% year-over-year rates. And critically, they’re not competing to build AGI—they’re providing the infrastructure that makes AI deployable.

Why Infrastructure Is Winning Whilst Foundation Models Struggle

The divergence between infrastructure platform success and foundation model struggles reveals a fundamental truth about technology adoption: enterprises don’t pay for potential, they pay for solutions to current problems.

OpenAI’s challenge is that it’s selling a vision of transformational AGI with uncertain timelines whilst burning billions to get there. The 95% failure rate for generative AI pilots isn’t because the technology is useless—it’s because enterprises attempting to deploy foundation models directly run into insurmountable infrastructure challenges: data quality issues, integration complexity, governance gaps, and lack of observability.

This is precisely where infrastructure platforms create value. Boomi’s platform uses AI to automatically fix data quality issues during loading—solving a problem that kills most AI initiatives before they start. The company’s agents auto-document APIs and integrations with 80% less time, identify network connections, and generate integration patterns by drawing on 300 million anonymised integrations in their system.

ServiceNow’s approach is telling. Rather than selling access to foundation models, they’re providing what amounts to an operating system for agentic AI—handling orchestration, governance, audit trails, and integration whilst allowing customers to use any LLM (Anthropic, OpenAI, Gemini, or industry-specific models). Enterprises aren’t locked into betting on which foundation model will win; they’re building on infrastructure that works regardless.

The adoption pattern reveals enterprise pragmatism. Companies aren’t waiting for AGI. They’re deploying agents today that watch commodity prices and inventory levels to make purchasing decisions, auto-generate sales proposals by analysing call transcripts, process expense reports automatically, and identify margin leakage in real-time. These are concrete use cases delivering measurable value.

What This Means for Your AI Strategy

If you’re a leader, consultant or product manager trying to navigate AI decisions, the infrastructure versus foundation model distinction has profound strategic implications.

First, recognise that AI bubble fears and genuine enterprise adoption acceleration are not mutually exclusive. Both can be true simultaneously.

The speculative mania around foundation models may indeed represent a bubble that will burst painfully. But underneath that financial froth, enterprises are steadily adopting practical AI solutions that solve real integration, automation, and data quality problems.

Second, focus your AI strategy on infrastructure and platforms, not models. Unless you’re in the business of building LLMs, you don’t need to pick winners in a model race.

What you do need is infrastructure that allows you to deploy AI in production, manage sprawl, ensure governance and compliance, and switch models as better options emerge.

Third, adopt a systematic framework for AI deployment that prioritises AI infrastructure readiness. Before launching another generative AI pilot, ensure you have:

Data quality and integration infrastructure: Can you move clean, high-quality data between applications in real-time? If not, your AI initiatives will fail regardless of which foundation model you choose.

API management and orchestration: How will you manage hundreds or thousands of agents? Do you have observability, governance, and the ability to kill misbehaving agents?

Audit and compliance capabilities: For regulated processes, do you have immutable logs tracking agent inputs, reasoning, and outputs? Can you satisfy auditors?

Platform flexibility: Are you locked into a single vendor’s models, or can you switch as better options emerge?

Companies like Boomi, ServiceNow, and MongoDB are growing rapidly because they solve these infrastructure challenges. Enterprises that build on this foundation can deploy AI at scale; those that don’t will continue experiencing the 95% failure rate.

Fourth, prepare for the infrastructure layer to thrive even if the speculative bubble bursts. Much like internet infrastructure survived and thrived after the dotcom crash, AI infrastructure platforms appear to be building sustainable businesses on genuine enterprise demand.

If OpenAI’s circular financing unwinds and model valuations crash, the companies providing integration, data management, and orchestration will likely continue growing because they’re solving problems enterprises will still have.

Fifth, watch deployment metrics, not hype cycles. The difference between a 10X increase in agent deployments over five months and a 95% pilot failure rate tells you everything you need to know about where real adoption is happening.

ServiceNow closing 89 deals over $1 million in a quarter, Palantir’s 157 such deals, MongoDB adding 2,800 customers—these are production deployment signals, not experiments.

The strategic implication is clear: bet on the picks and shovels, not the prospectors. The companies providing infrastructure for AI deployment have sustainable business models, real customer revenue, and measurable value propositions. This tells you where the value to unlock sits.

Ready to Build AI Infrastructure That Actually Works?

The AI infrastructure boom is happening now, whilst everyone else is distracted by bubble fears and AGI speculation. The companies that recognise this distinction—and invest accordingly—will build sustainable competitive advantages whilst their competitors chase foundation model hype.

Understanding the difference between speculative AI investments and infrastructure plays is just the beginning. The real challenge is implementing the platforms, processes, and governance that enable production AI deployment at scale.

Until next time,

Chris

Want deeper insights on navigating the AI infrastructure landscape? Upgrade to the paid tier and get access to tools and frameworks for deploying AI without getting caught in the bubble.